Riding the wave of the revival of the dragon 2020! Or will the western world bite back?

Since the spread of the COVID virus which hit the Western world in late January it took just over 6 months to remove trillions of $ of monetary value and assets and devalue corporate businesses

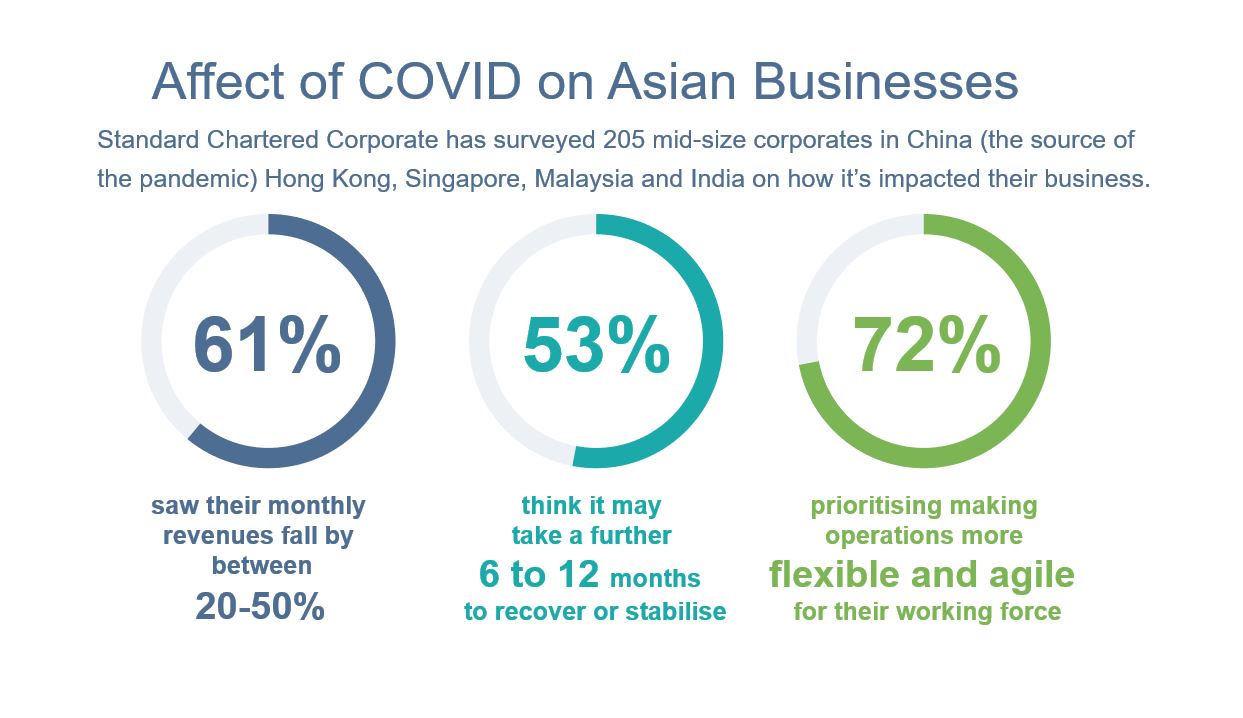

COVID has had a disruptive affect on livelihoods and the economic world like one has never seen in living memory. Standard Chartered Corporate has surveyed 205 mid-size corporates in China (the source of the pandemic) Hong Kong, Singapore, Malaysia and India on how its impacted their business.

61% saw their monthly revenues fall by between 20-50%.

53% think it may take a further 6 to 12 months to recover or stabilise.

72% are prioritising making operations more flexible and agile for their working force.

What is interesting it is believed that the tech giants are likely to come out of the global crisis as some of the only winners. Demand for their services has exploded as remote working becomes the new norm and e-commerce soars. More than ever, big tech firms such as Amazon are being seen as vital utilities in day-to-day life. Compared with other utilities, however, the tech sector faces few regulatory constraints. Whilst complaints about their practices pre-pandemic were rife since the crisis began antitrust investigations and policymaking have been put on hold. What needs to be clear are the approaches to things like:-

- What does the future hold for big tech in support of the changing way of the new norm?

- What will the perception of big tech be post-pandemic, the Saint or the Reaper?

- How will the role of big tech in facilitating survival during the crisis position the large digital social platforms in the future?

“What a lot of us may not know is that 300 of the world’s 500 top companies had facilities in Wuhan, China, meaning the strict lockdown imposed there had ramifications the world over, while many countries were left scrambling for vital medical supplies2 due to bottlenecks in the movement of freight. The question now is to what extent the pandemic will lead to a permanent change in the way multinational organisations operate their supply chains.” Commented Saif Malik, Global Head subsidiaries at Standard Chartered Bank.

He goes on to say, “Businesses across the world are reassessing their supply chain risks and will be helped by data and artificial intelligence as they weigh up the evolving risks and new opportunities. It’s fair to say that the role of CTO or CIO has never been more important. It is my hope that the changes adopted will build more resilient supply chains with the strength to future-proof global trade.”

So we should see more of the following changes as we move forward into the twenty twenties and beyond. We may see a change in mindset from the “just-in-time” supply chains that were largely driven by the desire for lean inventories, efficiency and cost savings. Additionally, a move towards the rise of digitisation of trade platforms, e-signatures, and digital customs clearance. It is also important to consider changes in the broader business and geopolitical landscape, as the cost is only one driver of behaviour. Companies will need to strategically map their own vulnerabilities, looking at any areas which could lead to interruptions.

“Businesses across the world will be reassessing their supply chain risks and this will be helped by data and artificial intelligence as they weigh up the evolving risks of new opportunities. It’s fair to say that the role of CTO or CIO has never been more important,” states Craig Ashmole, founding Partner of London based consulting firm CCServe Ltd, “and what I been saying for many years, there needs to be a seat at the top table in corporate firms for the CIO. This will enable the executive stakeholders make better informed decisions in this changing world.”

Thanks too for the comments of Saif Malik, Global Head subsidiaries at Standard Chartered Bank.

Recent Comments